There is certainly a lot of debt out there. Families fight about money all of the time.

There S A Lot Of Debt Out There So What

There S A Lot Of Debt Out There So What

The answer depends on how high your gross debt.

Lots of debt. Owning a home is the number one financial goal for many Canadians. A lot of us already do a lot of our shopping online because its often cheaper than shopping at brick and mortar stores but there is a way to save even more when you shop online. Companies are selling the most debt in a decade.

Lots of stories concerned about the debt ratio even though it has been steadily inching upwards since 1990 or as has been the case for the last few years remaining relatively flat. Randy and Gabriel have three properties lots of debt and no plan. Good Debt vs.

When you join Swagbucks you can get cash back when you buy online from more than 1500 retailers including places you probably already shop like Amazon Target and Starbucks. This is often considered the worst kind because it is far too easy to spend and carries the highest interest rate. NDP promises to wipe out a lot of student debt as parties prepare for election.

And it can be one of the most liberating things you ever do. Can they build a. ASK THE MONEY LADY.

Many Canadians on the other side have a large amount of debt including credit card debtAs a result an often asked question here in Canada is Is it possible to get a house mortgage if I have a lot of debt. For a lot of people confronting debt is the first step to becoming financially free. Take incremental steps to get back in the game writes Christine Ibbotson.

Aging parents who are concerned about their own debt may be defensive or secretive about finances. The NDP is promising to wipe out a large portion of existing student debt pause student loan payments and slap a. Mortgage debt and interest rates not consumer debt responsible for increasing debt ratio.

Lots of debt no financial plan. Federal state and local governments have accumulated a record 279 trillion of debt financing. But borrowing money and taking on debt is.

The NerdWallets 2017 American Household Credit Card Debt Study reported that Americans have 1315 trillion in total debt and the average household carries credit card debt of approximately 16000. With all that said what has actually caused the increasing debt ratio. Credit card debt one of the most common types of debt is obtained through credit cards.

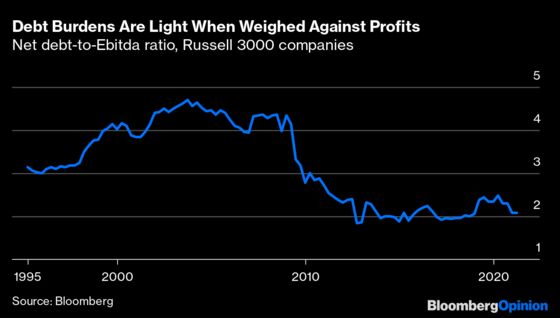

By Julie Cazzin on November 24 2014. Here are what I think are the five most important steps for getting out of debt. The riskiest entities are being rewarded with 52 more credit upgrades than rating downgrades as demand for exchange-traded funds with high.

Credit cards are used most often for daily expenses such as restaurants entertainment and clothing. A lot of us have a really hard time talking to our parents about money. However many people are drowning in credit card debt.

I have lots of debt should I declare bankruptcy. Thats why Ive committed to sharing with as many people as possible what it took to pay down debt while building a business and planning for the future. Is It Possible to Get a House Mortgage If I Have a Lot of Debt.

A lot of us go a long time without discussing the state of. Since 1990 heres a graph that breaks down. There certainly is an argument to be made that no debt is good debt.

Borrowing costs are the lowest in at least 70 years.

A Problematic Man In Lots Of Debt Clipart Cartoons By Vectortoons

A Problematic Man In Lots Of Debt Clipart Cartoons By Vectortoons

Debt Consolidation Loans In Omaha Ne

Debt Consolidation Loans In Omaha Ne

What Should I Know About Debt Consolidation Quora

What Should I Know About Debt Consolidation Quora

Poets Quants Graduating With An Mba Lots Of Debt

Poets Quants Graduating With An Mba Lots Of Debt

Avoiding Credit Card Debt Gq Law

Financial Literacy 3 Becoming Debt Free Financial Matters Attentive Investment Managers Stockton California

Financial Literacy 3 Becoming Debt Free Financial Matters Attentive Investment Managers Stockton California

Will My Debt Outlive Me Your Questions About Debt After Death Answered The Bernstein Law Group P C

Will My Debt Outlive Me Your Questions About Debt After Death Answered The Bernstein Law Group P C

3 Smart Ways To Rid Yourself Of Debt The Motley Fool

3 Smart Ways To Rid Yourself Of Debt The Motley Fool

8 Ways To Get Out Of Debt In 2020 Credit Com

8 Ways To Get Out Of Debt In 2020 Credit Com

Global Economics Lots Of Debt And No Deleveraging

Global Economics Lots Of Debt And No Deleveraging

:max_bytes(150000):strip_icc()/man-holding-shopping-bags-in-mall--low-section-200142282-001-5b76df98c9e77c00254fe898.jpg) Learn 9 Reasons Debt Is Bad For You

Learn 9 Reasons Debt Is Bad For You

Proven Tactics To Overcome Big Debts Kiplinger

Proven Tactics To Overcome Big Debts Kiplinger

/womanlookingatreceipts_DavidSacks_Getty-56a1de613df78cf7726f5850.jpg)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.