Wages if you work abroad. However you may qualify to exclude your foreign earnings from income up to an amount that is adjusted annually for inflation 103900 for 2018 105900 for 2019 107600 for 2020 and 108700 for 2021.

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

A Step By Step Guide To Form 1116 The Foreign Tax Credit For Expats

The Foreign Earned Income Exclusion can result in huge savings for US expat taxes.

How much foreign income is tax free in usa. Furthermore even if the foreign corporation takes the. You report the Foreign Earned Income Exclusion on a special Form 2555 in which you indicate if you meet the Physical Presence or Bona-Fide Resident test. Foreign earned income is income you receive for services performed in a foreign country during the period your tax home the general area of your main place of business employment or post of duty where you are permanently or indefinitely engaged to work is in a foreign country and whether you meet the bona fide residence test or physical presence test.

If your foreign earned income was less than 107600 use the FEIE to reduce your US tax on this income to zero. There is no minimum dollar amount of income that triggers a filing requirement for a nonresident alien including a foreign student or a foreign scholar. The most common arrangement is for the USA to allow a credit for.

How or where you are paid has no effect on the incomes. Person and you have a foreign pension earned in a foreign country in which there is no tax treaty. Provided that if the total income of the person does not exceed 500000 the fee payable under this section shall not exceed 1000.

For the tax year 2020 you may be eligible to exclude up to 107600 of your foreign-earned income from your US. For individuals the top income tax rate for 2021 is 37 except for long-term capital gains and qualified dividends discussed below. 115-97 reduced both the individual tax rates and the number of tax brackets.

A taxable scholarship or fellowship grant as described in Chapter 1 of Publication 970 Tax Benefits for Education. You may need to pay UK Income Tax on your foreign income such as. Rental income on overseas property.

More about that later. For the tax year 2021 this amount increases to 108700. Forex futures and options are 1256 contracts and taxed using the 6040 rule with 60 of gains or losses treated as long-term capital gains and 40.

In addition you can exclude or deduct certain foreign housing amounts. Filing IS required by nonresident alien students and scholars who have. For 2014 the maximum foreign earned income exclusion is 99200.

However if you reported 10000 worth of Social Security income and have been receiving it since 1996 5000 is tax-exempt lowering that portion of your taxable income to 5000. For example lets say you are a US. 2 The provisions of this section shall apply in respect of return of income required to be furnished for the assessment year commencing on or after the 1st day of April 2018.

Every foreign corporation that is engaged in a trade or business in the United States is required to file a US. This means you can exclude up to 104100 on your US tax return. 115-97 sunsets after 2025 many individual tax provisions including the lower rates and revised.

Personal income tax rates. For 2018 the amount is 104100. Foreign Earned Income Exclusion FEIE can lower or eliminate income tax.

Some expats however benefit more from the Foreign Tax Credit. Yes and it can happen that the foreign country may tax the same income. And although the foreign pension is under your name and has accumulated nearly 1000000 it doesnt actually vest or at least the majority of it under the foreign countries laws for another 20 years.

The FEIE is one of the most beneficial exclusions for many Americans abroad. Reporting Foreign Financial Assets and Accounts There has been a requirement for many years to report foreign income referred to as FBAR foreign bank and financial accounts report. Foreign investment income for example dividends and savings interest.

However if your foreign income was more than 107600 explore the possibility of using your foreign taxes as credit against any US tax which may be due. Starting with your gross income of 40000 62 of that is taken for Social Security costs taking 2480 from you. You cannot exclude or deduct more than your foreign earned income for the year.

Exclude means you dont pay taxes on it. 145 of your gross income is taken for your Medicare costs taking 580 from you. Because of that the USA has entered into tax treaties with many other countries to prevent double taxation.

Corporate income tax return Form 1120-F even if the foreign corporation has no US-source income or all of its income is exempt from tax under the terms of a tax treaty. That reduces the portion of your taxable income to 8500. Through the FEIE US.

Your employer pays FICA tax with is 3060 the addition of both.

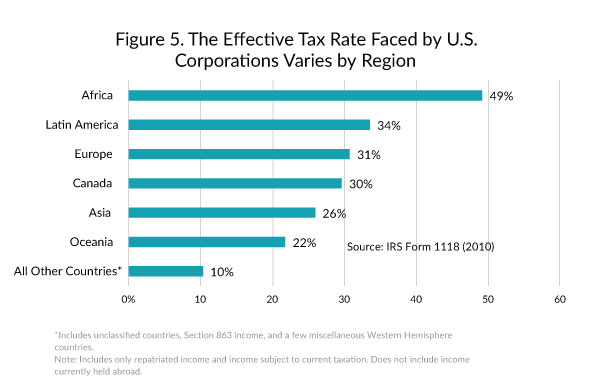

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How To Report Foreign Earned Income On Your Us Tax Return

How To Report Foreign Earned Income On Your Us Tax Return

What Are The Consequences Of The New Us International Tax System Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

U S Multinationals Paid More Than 100 Billion In Foreign Income Taxes Tax Foundation

U S Multinationals Paid More Than 100 Billion In Foreign Income Taxes Tax Foundation

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Foreign Earned Income Exclusion And Us Or Irs Tax Returns

Foreign Earned Income Exclusion And Us Or Irs Tax Returns

Publication 54 2020 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Publication 54 2020 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

How Does The Current System Of International Taxation Work Tax Policy Center

How Does The Current System Of International Taxation Work Tax Policy Center

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

Publication 54 2020 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Publication 54 2020 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Foreign Earned Income Exclusion For U S Citizens In China China Briefing News

Foreign Earned Income Exclusion For U S Citizens In China China Briefing News

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

How Much Do U S Multinational Corporations Pay In Foreign Income Taxes Tax Foundation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.