Youre already registered as self-employed and traded in the 202021 tax year. Your income must be mostly through self-employment.

Claim A Grant Through The Coronavirus Covid 19 Self Employment Income Support Scheme

Self-employed individuals including those earning income from commissions.

How to claim self employment income. The Self-Employment Income Support Scheme is open for claims. The fourth Self-Employment Income Support Scheme grant is worth up to 7500. If you are eligible HMRC will contact you in mid-April to give you your personal claim date.

If you are starting a small business see the Checklist for small businesses. If you are incorporated this information does not apply to you. Youll figure your self-employment tax on Schedule SE.

Who can apply and how to apply is answered in this article delivered delivered by the NFFO. You must have already filed your 201920 Self Assessment tax return. Gross income lines 13499 13699 13899 14099 and 14299 and Net income lines 13500 13700 13900 14100 and 14300 Report self-employment income or loss from a business a profession commission farming or fishing.

Remember agents cant apply for their self-employed clients. Self-employed taxpayers report their business income and expenses on Schedule C. The checklist provides important tax information.

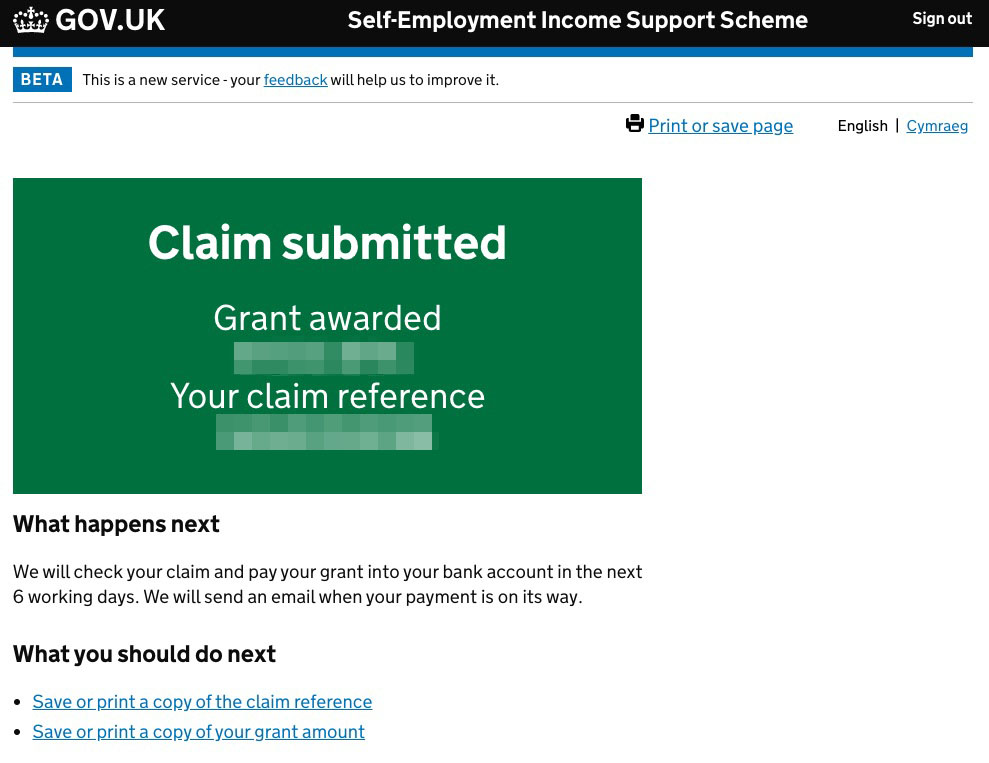

This will be the date that you can make your claim from. If you are working in the UK and are Self-employed or a member of a Partnership and have lost income due to COVID-19 you may be entitled to claim the Self-Employed Income Support Scheme. Use the online service to check the status of your payment update your details see how much you were paid or if.

TurboTax can help make the job easier. Self Assessment Unique Taxpayer Reference UTR National Insurance number. Before you can determine if you are subject to self-employment tax and income tax you must figure your net profit or net loss from your business.

If your expenses are less than your income the difference is net profit and becomes part of your income on page 1 of Form 1040 or 1040-SR. Trading profits must be no more than 50000 and at least equal to non-trading income. Whats new for small businesses and self-employed.

This means being self-employed is your main job you work regularly and expect to make a profit. Those who qualify must make their claim for the fourth grant on or before 1 June 2021. To be eligible for the fourth grant you must be a self-employed individual or a member of a partnership.

You will need to keep a record of evidence of how your business has been adversely affected. Do I qualify for COVID-19 self-employed income support. Instead go to Corporations.

So make the claim yourself to avoid delays to payments. Consider income expenses and vehicle information Each year sole proprietors have the chore of preparing and filing Schedule C with their 1040 to show the IRS whether their business had a taxable profit or a deductible loss. Report income earned outside Canada from a foreign employer.

Instead you must report your self-employment income on Schedule C Form 1040 to report income or loss from any business you operated or profession you practiced as a sole proprietor in which you engaged for profit. Return to your claim for the Self-Employment Income Support Scheme. The income you earn as a self-employed person is listed on Line 104 Employment income not reported on a T4 slip Form T1 is also where you report any personal deductions for which youre eligiblefor instance ones that apply if you support a dependant or live in a northern territoryprovince.

From 31 July the minimum income floor might apply to you if youre in gainful self-employment. All grants so far have the same eligibility criteria. Learn more about the scheme below.

You do this by subtracting your business expenses from your business income. The second taxable grant is worth 70 per cent of your average monthly trading profits paid out in a single instalment. If your expenses are more than.

There is no W-2 self-employed specific form that you can create. You cannot claim the grant if you trade through a limited company or a. If you think you might be eligible check if you can make a claim.

1507 11 MAY 2021. For full details visit GOVUK and search Self-Employment Income Support Scheme. The grant is subject to income tax and self-employed national insurance.

You must have traded in the tax year 2018 to 2019 and submitted your Self Assessment tax return on or before 23 April 2020 for that year. You have to earn less than 50000 per year. All types of income.

Linda Howard Money-Saving Consumer and Shopping Writer. Youll also need to be in the all work-related requirements group - this. What youll need to make your claim.

Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Covid 19 Support Gov Uk

Self Employed Invited To Get Ready To Make Their Claims For Coronavirus Covid 19 Support Gov Uk

Millions Of Self Employed To Benefit From Second Stage Of Support Scheme Gov Uk

Millions Of Self Employed To Benefit From Second Stage Of Support Scheme Gov Uk

Hm Revenue Customs On Twitter New From 17 August Customers Will Be Able To Claim Their Second Self Employed Income Support Scheme Grant As Jimharrahmrc Has Just Told Martinslewis Itvmlshow Https T Co Wh0nx1qhs5

Hm Revenue Customs On Twitter New From 17 August Customers Will Be Able To Claim Their Second Self Employed Income Support Scheme Grant As Jimharrahmrc Has Just Told Martinslewis Itvmlshow Https T Co Wh0nx1qhs5

Coronavirus Self Employment Income Support Scheme Seiss Low Incomes Tax Reform Group

Coronavirus Self Employment Income Support Scheme Seiss Low Incomes Tax Reform Group

How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

How Do I Pay Tax On Self Employed Income Low Incomes Tax Reform Group

Hm Revenue Customs On Twitter If You Re Eligible For The Self Employment Income Support Scheme You Could Receive A Taxable Grant Up To 7 500 You Can Also Use Our Checker To Find

Hm Revenue Customs On Twitter If You Re Eligible For The Self Employment Income Support Scheme You Could Receive A Taxable Grant Up To 7 500 You Can Also Use Our Checker To Find

How To Submit A Self Employment Income Support Scheme Seiss Claim

How To Submit A Self Employment Income Support Scheme Seiss Claim

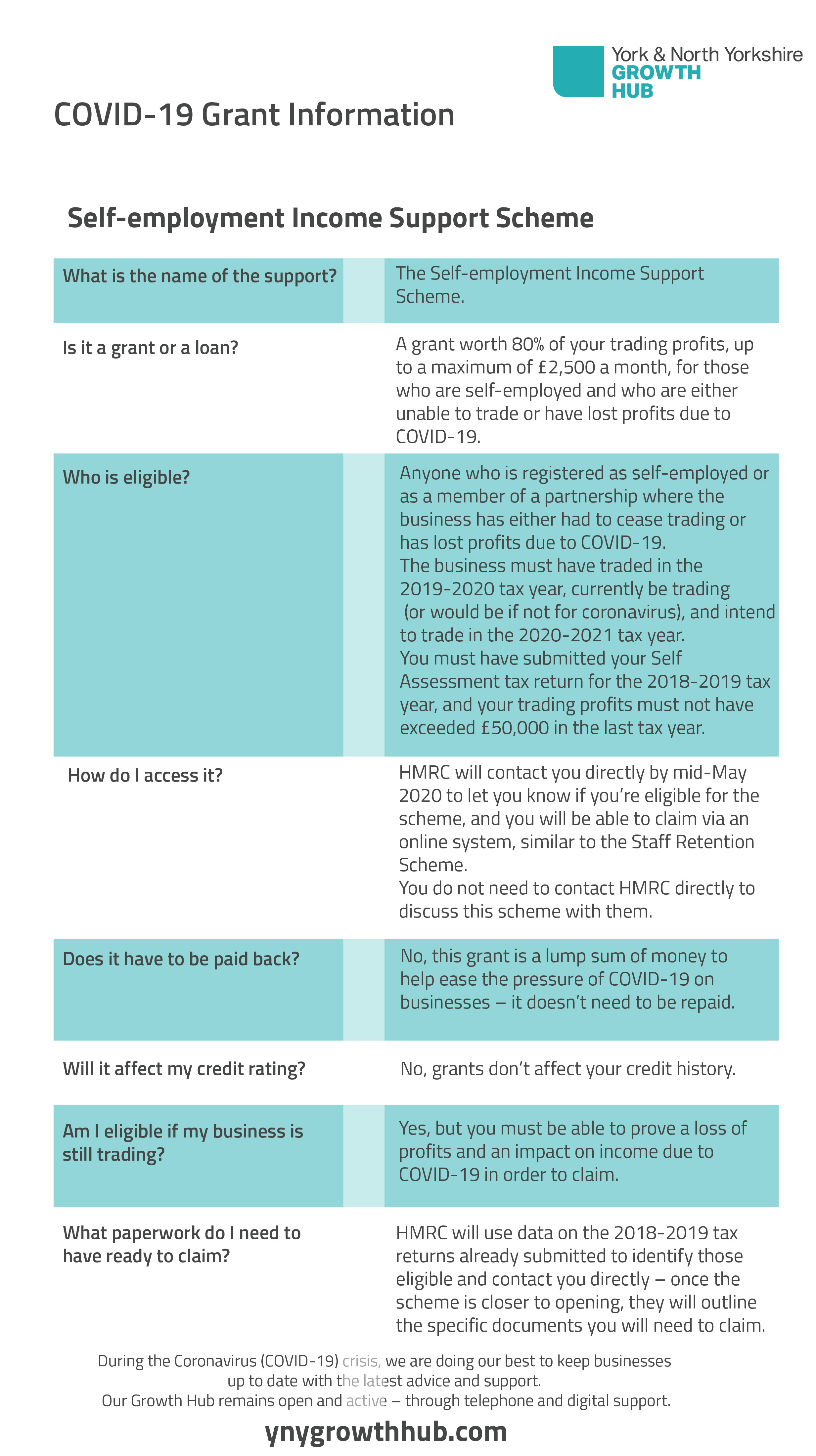

Quick Guide Self Employment Income Support Scheme Y Ny Growth Hub

Quick Guide Self Employment Income Support Scheme Y Ny Growth Hub

Applications For Self Employment Income Support Scheme Open Early Gov Uk

Applications For Self Employment Income Support Scheme Open Early Gov Uk

How To Claim A Grant Under The Self Employment Income Support Scheme Seiss Low Incomes Tax Reform Group

How To Claim A Grant Under The Self Employment Income Support Scheme Seiss Low Incomes Tax Reform Group

How To Claim The Uk Covid 19 Self Employment Income Support Scheme

How To Claim The Uk Covid 19 Self Employment Income Support Scheme

Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom

Coronavirus Self Employment Income Support Scheme What You Need To Know Sage Advice United Kingdom

How To Submit Your Self Employment Income Support Scheme Claim Taxassist Accountants

How To Submit Your Self Employment Income Support Scheme Claim Taxassist Accountants

Check If You Can Claim A Grant Through The Self Employment Income Support Scheme Numeric Accounting Limited

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.