Google has many special features to help you find exactly what youre looking for. This card offers a process that presents you with a credit line based on your creditworthiness before you apply.

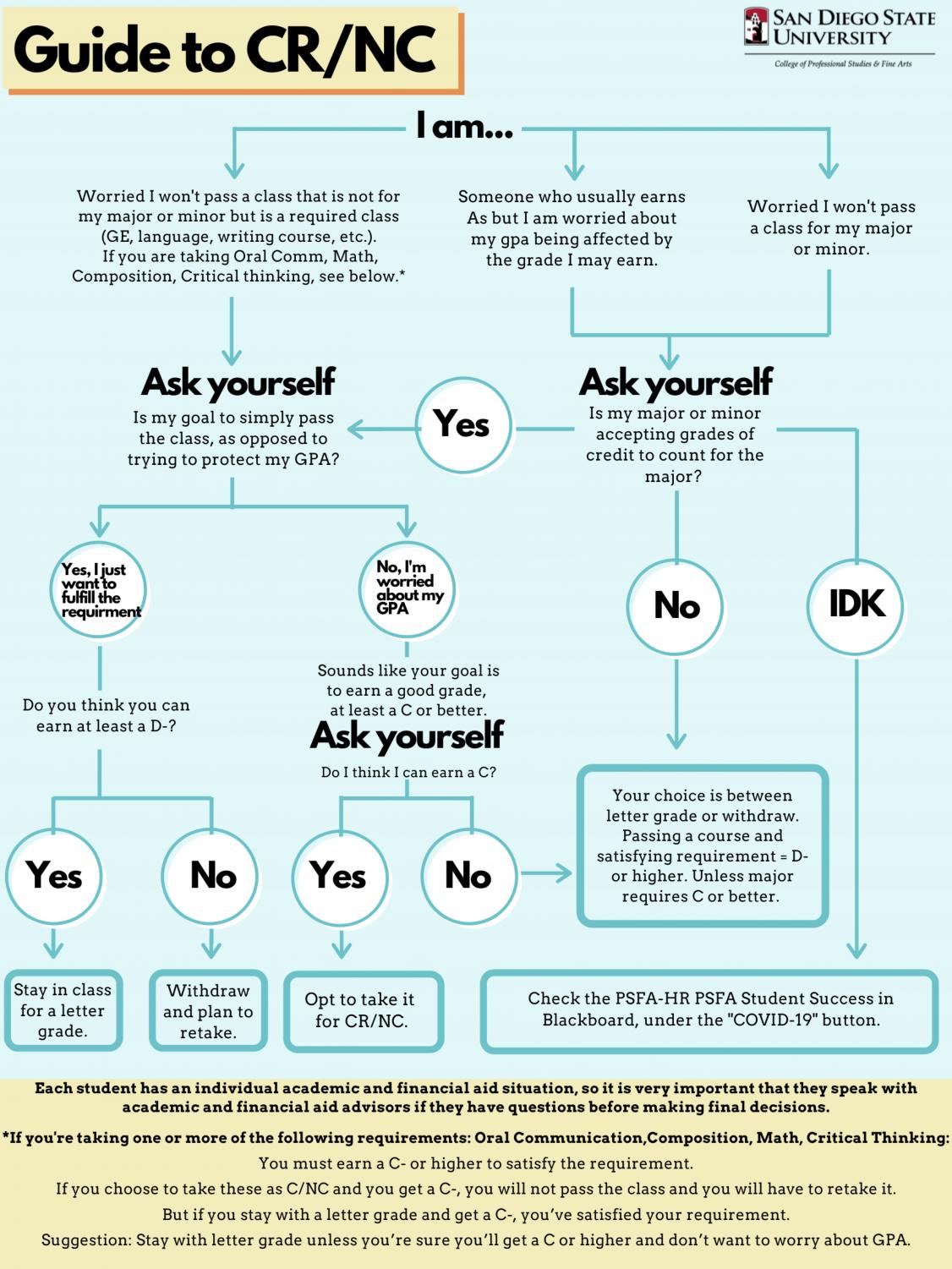

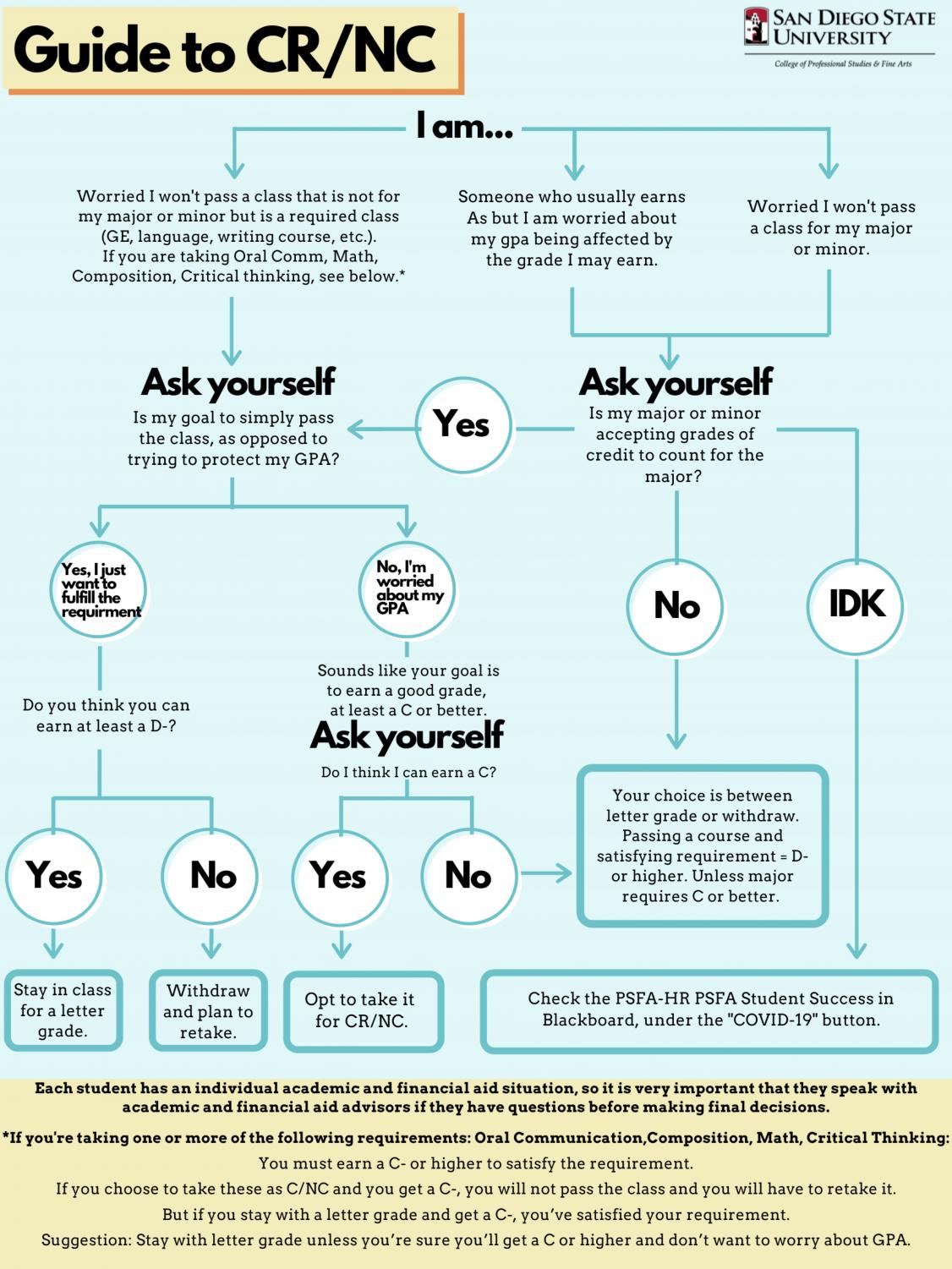

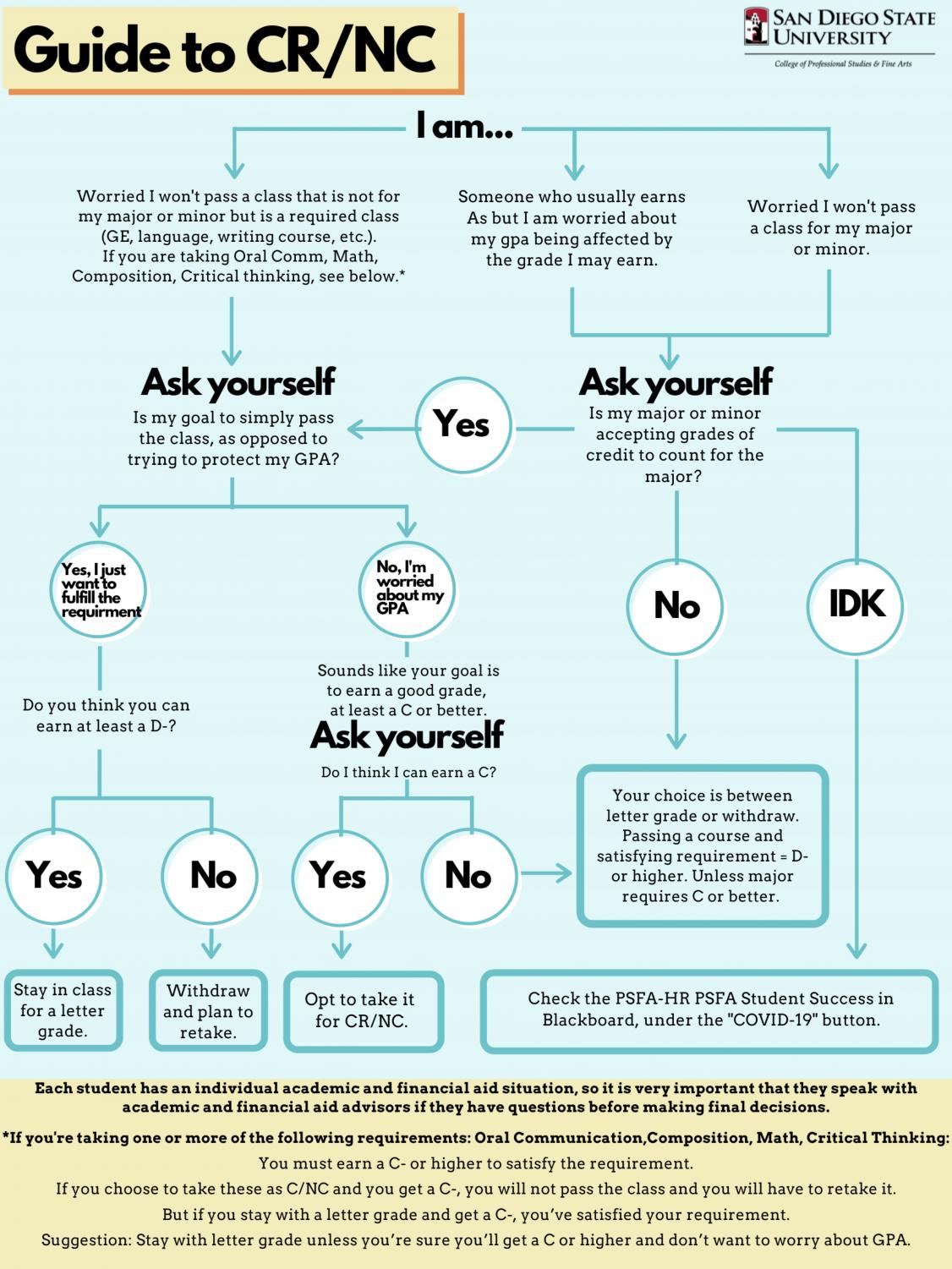

Understanding Sdsu S Credit No Credit Option Course Withdrawal Extension The Daily Aztec

Understanding Sdsu S Credit No Credit Option Course Withdrawal Extension The Daily Aztec

Can You Get a Credit Card at 18.

Im 19 with no credit. Can only be used at Fingerhut. The number of active accounts on your report is a factor in calculating your scores. As an authorized user you can piggyback off the primary account holders credit and as a result establish your own credit history.

Also theres no hard pull on your credit and no credit history is required. Qualifying for a bank loan can be tough when youre 19 years old and havent established an extensive work or credit history. This card is available to students with limited or no credit history too.

It also has no penalty or hidden feesa perfect fit. Getting a credit card isnt easy at 19. Most scoring models look for activity within the last two years.

The Capital One Journey Card also has. Although it only works for Montgomery Ward purchases online or through the companys catalogue the Montgomery Ward credit card reports to the credit bureaus on. If youve had credit in the past but no longer use credit cards or you have closed accounts on your report there.

However just because you dont have a credit score doesnt mean you arent a good credit risk. The Self Credit Builder Account has a one-time account fee of 9 to 15 which varies by the product. Simply paying your cell-phone bill on time could be enough to get a lender to take a second look.

It just takes a little time and the right opportunity to begin building your credit. However with some planning and foresight a 19-year-old can still get a credit card and build a score. Unsecured means that you do not pledge collateral that the lender can repossess should you default on the obligation.

No credit means youre a blank slate and youre an unknown credit risk for lenders. Journey Student Rewards from Capital One One of the best credit cards for students with no credit is the Journey Student Rewards from Capital One card because it has a 0 annual fee and gives 1 cash back on all purchases 125 back in months you pay your bill on time. My CU offers a share loan.

Credit Cards for No Credit. Search the worlds information including webpages images videos and more. Reports to all three major credit bureaus.

But ensure that the person liable on the account keeps up with payments because negative reporting to the bureaus will appear on your credit report if you are an authorized user. Go to a CU and ask them what secured credit options they have. Per the Credit CARD Act of 2009 consumers younger than 21 must have proof of independent income or a co-signer in order to get a credit.

No credit is sometimes confused with bad credit but the two are very different. Bad credit is the result of a history of financial missteps including late payments maxed-out credit cards or bankruptcy. Luckily there are a few credit card options for young people with little or no credit.

These tips can help make you look good when youre searching for your next no credit check apartment. Here are the best store credit cards for no credit. But you should not get discouraged.

What to know before accepting COVID-19 credit card relief If credit card reliefs a no-go check out debt management Food delivery options and how your credit card can help 3 ways. The credit score you get online whether free or purchased is an educational credit score and typically not the same credit score your lender is going to use. If you dont have the money to make a security deposit consider an unsecured credit card such as the Avant Credit Card.

Find credit cards geared to individuals in your age range and credit history. There are lenders willing to work with you but we know that finding one of them can be a challenge on its own. Worried about your credit history.

Basically you put up 500 of your own dollars in a secured account meaning you cant touch it then the CU loans you back the 500. Lets start with age. So you walk out with the same amount of money you came in with and a loan.

21 Year Old With No Credit Where Should He Start. There are still cards available for those with no credit history and getting a credit card can be an important first step in starting to build your credit. In fact an auto loan is great way to do this if you find the right lender.

Trying to build credit can appear daunting as most credit cards are designed for people with established credit. Instead they must file a lawsuit before garnishing wages. In some cases if you have an insufficient credit history or bad credit becoming an authorized user can help you build credit because the account history may be reported on your credit report.

The Credit Score You Check Is the Same One a Lender Will See. First-Time Personal Loans No Credit. While the educational credit score can give you a general idea of your credit health you cant take for granted that youll be approved based on that score.

In PR they do a lot of promotions at the start of the semester and pretty much anyone with a job 3 months at job minimum here can get one starting with a 300 limit and increases to a max of 500 on the 6th month. Montgomery Ward Credit Account. No monthly or one-time fees.

First-time personal loans can prove more challenging for 18-year-olds with no credit history to obtain because the contracts are unsecured. Capital One QuicksilverOne Cash Rewards Credit Card Why its the best flat-rate rewards credit card for people with no credit. As someone else mentioned before if he is in college a student visa or something similar would be the way to go.

To make matters worse the 2009 Credit Card Act imposes extra credit card restrictions for young adults. Dont be discouraged if you have no credit history at a young age. Authorized users also have zero liability so this is a low.

Food Freezer Bags Biodegradable Compostable 30 Bags Amazon Co Uk Grocery

Food Freezer Bags Biodegradable Compostable 30 Bags Amazon Co Uk Grocery

/wind-farm---sunset-903691050-5b9c0da9c9e77c00503b0fa2.jpg)