Mortgage refinance rates for May 17 2021. Mortgage rates have dropped to 50-year lows in response to global concerns regarding the coronavirus outbreak The Federal Reserve cut its benchmark interest rate to 0 on Sunday.

Low Mortgage Rates Strong Labor Market Fueling Housing Market Freddie Mac

Getting a Lower Interest Rate.

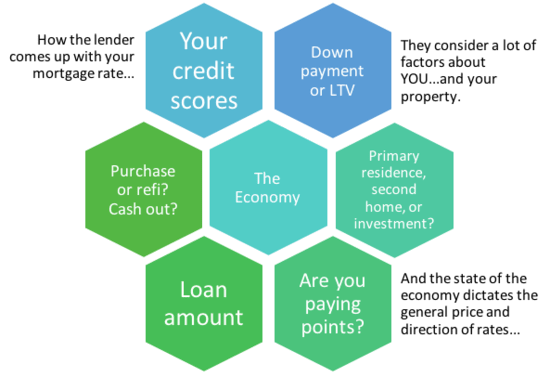

Mortgage interest rates lowered. If youre aiming to lower your mortgage interest rate you should be looking at conventional loans and these will require a minimum FICO credit score of 620. This causes the economy to grow and inflation to increase. These points allow you to pay a little more upfront for a lower mortgage payment over the life of your loan.

To get the best deal you can follow these steps to get a lower mortgage interest rate. Its important to look at all factors when evaluating if now is the right time to refinance your mortgage. It will encourage consumers and firms to take out loans to finance greater spending and investment.

The decline came even though the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 548250 or less decreased to 317. In general lenders require borrowers to refinance into a new home loan in order to change their mortgage rate requiring the borrower to requalify the house to pass an appraisal and the homeowner to again pay closing costs. While its true the Fed has lowered its interest rate that doesnt necessarily mean your available mortgage rate is going to be lower.

Lower mortgage interest payments. You might not be able to take advantage of lowered interest rates. It can also be to your advantage to refinance to a lower mortgage interest rate even when you are managing your finances well.

Refinancing Your Home to Lower Interest Rates. When mortgage rates drop homeowners often wonder if they will be able to take advantage of lower rates. Method 2 of 3.

Typically a point costs 1 of your total loan amount and can lower your rate by. The new year has kicked off with a new interest rate and it is lower than it has ever been. In the United States mortgage rates are typically set in relation to 10-year treasury bond yields which in turn are affected by Federal Funds rates.

If you find yourself falling behind in making your mortgage payments being honest with your lender may get you a lower interest rate without you having to refinance a new loan. Inflation and interest rates. One last trick some folks use to reduce their mortgage interest expense is opening a second mortgage to pay off the first.

Freddie Macs nationwide survey of mortgage rates released on Thursday showed the average on a 30-year mortgage at 298 percent the first time this key rate has fallen below 3. The average 30-year fixed mortgage rate fell 6 basis points to 321 from a week ago. Improving your credit score can translate to lower mortgage rates and significant savings over the life of the loan.

This can be done with either a fixed-rate home equity loan or adjustable-rate HELOC. Mortgage interest rates closed at 265 last week for 30-year fixed-rate loans based on the weekly. Its basically a form of arbitrage where rates are lower on the second than the first for one reason or another.

Those with adjustable-rate mortgages can also benefit from lower rates. Choose a time period with lower interest rates. Interest rates in the.

How to Lower Your Mortgage Interest Rate Method 1 of 3. How to get a lower mortgage interest rate 1. Losers include those who are unable to take advantage of lower.

From 2001 to 2006 interest rates were dramatically lowered due to the Dot-com crash but then increased from 2006 to 2007. A fall in interest rates will reduce the monthly cost of mortgage repayments. The 15-year fixed mortgage rate fell 9 basis points to 248 from a week ago.

Lower interest rates make the cost of borrowing cheaper. The Fed controls key short-term interest rates not mortgage loan interest rates. As interest rates are lowered more people are able to borrow more money.